You might have seen or used it – pay by bank is a new way to buy products online without the hassle of entering any of your card details.

This week, we learnt that Amazon had become the latest mega merchant to roll out the payment method for shoppers to use when purchasing products or setting up Prime subscriptions.

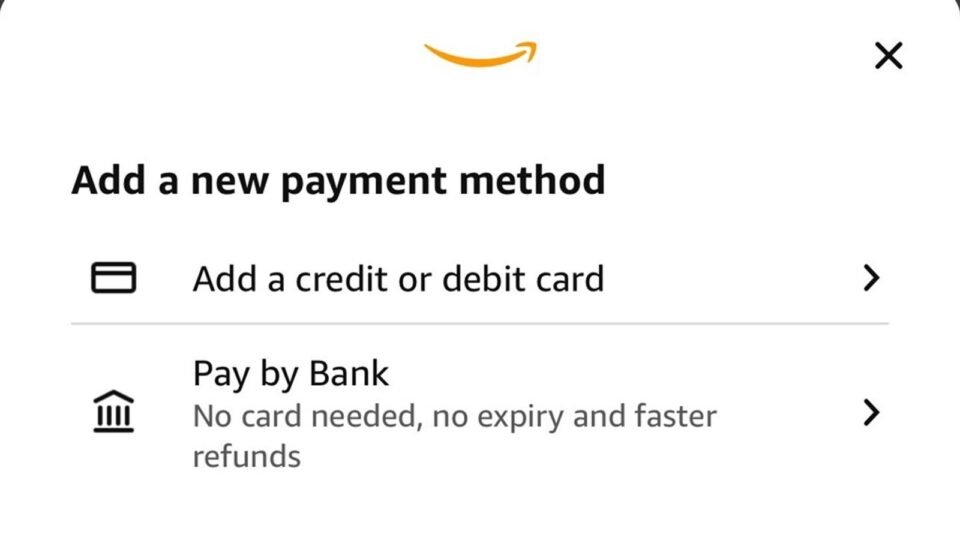

Here’s an example of what it looks like…

Pay by bank allows customers to transfer funds directly from their bank accounts to retailers, without the need to enter any credit or debit card details.

As well as Amazon, the method is supported by several household names, including Ryanair and Just Eat.

Read all the latest Money tips and deals here

For consumers, the new payment method offers speed and simplicity, with no need for a physical card to complete a transaction.

Retailers also benefit from reduced transaction costs.

Despite its growing popularity, consumer rights expert Scott Dixon has raised concerns about the protections customers give up when they opt to pay in this way.

He says it removes or weakens key consumer protections – Section 75 and chargeback – two of the most powerful refund routes available to consumers.

Read more from Money:

How hidden card service could save you hundreds

How to pick out a good steak

Britons told to use Ryanair ‘add-ons trick’ – prompting angry statement from airline

This means that if the seller goes bust, refuses to refund you or delivers faulty goods, you are effectively on your own.

You don’t need to stop using pay by bank completely, but it’s not ideal for all purchases, Dixon says.

Before deciding whether it’s worth plucking your card out, Dixon says you should ask yourself these questions:

- Do I trust this seller?

- Can I afford to lose this money if the purchase goes wrong?

- Why can I not pay by debit or credit card?

- Am I happy to give up my right to a chargeback or Section 75 protection?

If the answer is no to any of those questions, it’s worth taking the extra time to pay using your card.

Dixon recommends avoiding it, especially for high-ticket items such as holidays, electronics, cars and sofas, future-dated purchases like concert tickets or hotel bookings, and when buying something from an unfamiliar seller.

If you’re spending more than £100 on a purchase, Dixon says you get the strongest protection by paying at least the deposit on a credit card.

For anything under £100, you should try to pay with a debit card to benefit from chargeback, which covers you for up to 120 days from the date of purchase.